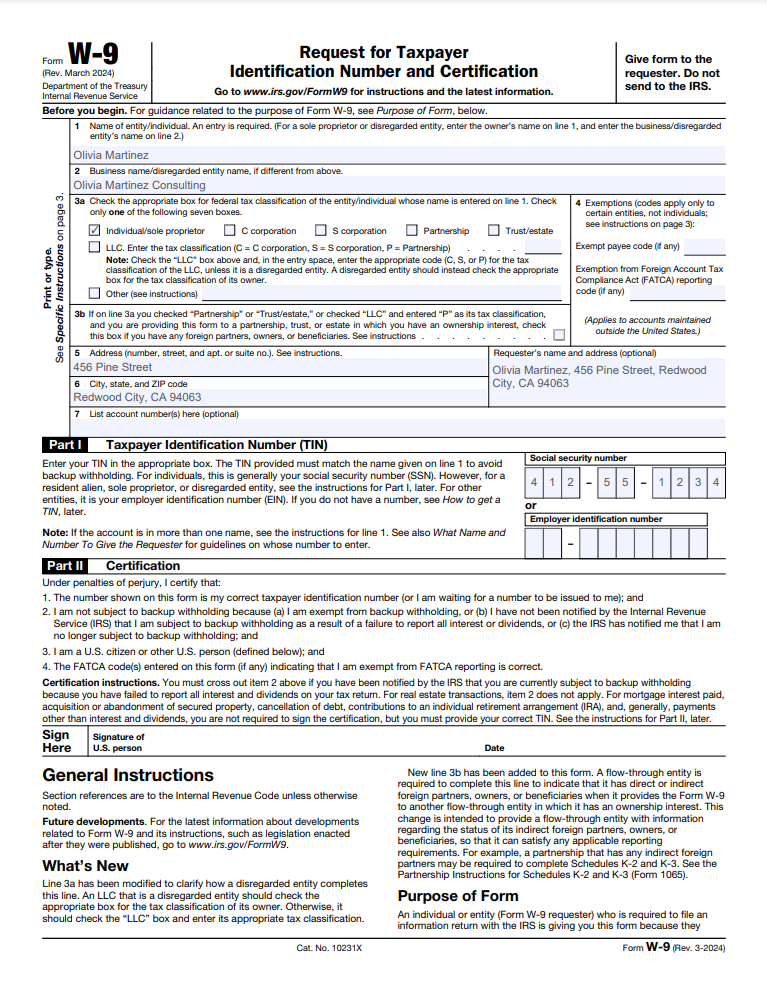

Request for Taxpayer Identification Number and Certification. Example of filled Form W-9

Form W-9 is used to provide your Taxpayer Identification Number (TIN) to a person or company that must file an information return to the IRS. This commonly occurs when you are paid as an independent contractor, sole proprietor, or under other circumstances requiring tax reporting. To provide an example of a completed W-9 form, I'll outline the necessary steps and details based on official guidelines and best practices.

For a detailed guide on how to fill out the W-9 form, watch this short video: How to Fill Out the W-9 Form.

Page 1

-

Name (as shown on your tax return):

- Name: Olivia Martinez

-

Business Name/Disregarded Entity Name (if different from above):

- Business Name: Olivia Martinez Consulting

-

Federal Tax Classification:

- Check Only One: Individual/Sole Proprietor or Single-Member LLC

(Olivia is a freelance consultant operating as a sole proprietor. She selects “Individual/Sole Proprietor or Single-Member LLC.”)

- Check Only One: Individual/Sole Proprietor or Single-Member LLC

-

Exemptions (if any):

- Leave blank if you are not exempt.

-

Address, City, State, and ZIP Code:

- Street Address: 456 Pine Street

- City and Zip Code: Redwood City, CA 94063

-

Requester’s Name and Address (Optional):

- If the payer has provided this, enter it here. Otherwise, leave it blank.

-

Taxpayer Identification Number (TIN):

- Social Security Number (SSN): 412-55-1234

(If you have an Employer Identification Number (EIN), you can provide it instead.)

- Social Security Number (SSN): 412-55-1234

-

Certification:

By signing, you certify under penalty of perjury that the information you provided is correct and that you are not subject to backup withholding unless otherwise noted.- Signature: Olivia Martinez

- Date: 06/15/2024

How to Fill Out Form W-9 for Independent Contractors

When it comes to filling out Form W-9 as an independent contractor, it's essential to follow a structured approach to ensure accuracy and compliance with IRS requirements. Here are the key steps tailored specifically for independent contractors:

-

Identify Your Status: As an independent contractor, select 'Individual/Sole Proprietor or Single-Member LLC' in the Federal Tax Classification section. This designation is crucial as it reflects your independent status, affecting tax reporting.

-

Provide Your Business Information: In the Business Name section, include your business name if you operate under a different name than your legal name. For instance, if you are a freelance graphic designer named Alex Smith operating as "Creative Designs", enter "Creative Designs" in this field alongside your legal name.

-

Enter Your Taxpayer Identification Number: Use your Social Security Number (SSN) if you're not registered as a corporation. If you have an Employer Identification Number (EIN) for your freelance business, you may choose to use that.

-

Review Signature and Date Requirements: Always remember to sign and date the form; the W-9 will not be valid without these. Ensure your signature matches your legal name.

-

Ensure Secure Handling of Sensitive Information: Given that the W-9 contains sensitive data, always transfer this document securely to prevent unauthorized access. Use encrypted email or a secure online portal as recommended by the requester.

By following these steps, independent contractors can fill out Form W-9 with confidence, ensuring that they meet the necessary tax reporting requirements and protect their personal information.

Additional Documents to Include

Generally, a W-9 does not require additional documents. However, if the requester has asked for supporting documentation (such as a business license or proof of EIN), include it as instructed.

Submitting the Form

-

Assemble Your Submission:

- Completed W-9 form.

- Any requested supporting documents.

-

Mailing or Sending Electronically:

Send your completed W-9 to the requester (company or individual needing your TIN). Follow their instructions for submission, which may include mailing to a provided address or uploading via a secure online portal.

Example of a Completed W-9 Form

Below is a screenshot of a completed W-9 form for reference. This example shows how your form should look when properly filled out.

Download filled Form W-9 Form PDF example

Form W-9 form in this example was filled out using Instafill.ai, an online AI Form Filler that primarily assists in swiftly and meticulously completing government forms and PDF documents. This tool is designed to streamline your paperwork tasks by eliminating human errors and saving time.

Tips for Completing Form W-9

1. Provide Accurate Information

- Match Your Tax Return: Use the exact name and TIN reported on your tax return.

- Keep Your Records Updated: If your address or name changes, submit a new W-9 to the requester.

2. Use the Correct TIN

- SSN or EIN: Individuals typically use their SSN, while businesses often use their EIN.

3. Sign and Date

- Validity: Your W-9 isn’t valid without a signature and date.

- No Digital Signature (Unless Allowed): Follow the requester’s instructions if they require a wet signature or accept electronic signatures.

4. Protect Your Information

- Secure Transfer: Since the W-9 contains sensitive information, send it through a secure channel (e.g., encrypted email or secure file upload) if possible.

5. When in Doubt, Seek Guidance

- Professional Advice: If you’re unsure about any portion of the form, consult a tax professional.

- Online Resources: The IRS website and instafill.ai offer guidance and support.

Common Mistakes to Avoid When Filling Out Form W-9

When completing Form W-9, it is crucial to be meticulous to avoid errors that could lead to delays or complications in the tax reporting process. Here are some common mistakes to watch out for:

Inconsistent Naming

Ensure that the name provided on the Form W-9 matches exactly the name on your tax return. Any discrepancies can lead to issues with the IRS matching your records, so it is essential to double-check this information.

Incorrect Taxpayer Identification Number (TIN)

Using the wrong TIN, whether it is a Social Security Number (SSN) or an Employer Identification Number (EIN), can cause significant problems. Make sure to use the correct TIN that corresponds to your tax status.

Missing or Incorrect Address

The address provided must be accurate and up-to-date. This includes the street address, city, state, and ZIP code. An incorrect address can result in missed communications and delays.

Unchecked or Incorrect Federal Tax Classification

Selecting the wrong federal tax classification can affect how your taxes are reported. Ensure you check the correct box that reflects your tax status, such as "Individual/Sole Proprietor or Single-Member LLC."

Omitting Signature and Date

The Form W-9 is not valid without a signature and date. Always sign and date the form, and ensure the signature matches your legal name.

Failing to Secure Sensitive Information

Given the sensitive nature of the information on Form W-9, it is vital to transfer the document securely. Use encrypted email or a secure online portal to protect your personal and business information.

Ignoring Requester’s Instructions

If the requester has provided specific instructions for filling out or submitting the Form W-9, make sure to follow them carefully. Ignoring these instructions can lead to the form being rejected or delayed.

Not Updating Information

If your name, address, or other details change, it is essential to submit a new Form W-9 to the requester. Failure to update this information can lead to inaccuracies in tax reporting.

By being aware of these common mistakes, you can ensure that your Form W-9 is completed accurately and efficiently, avoiding any potential issues with tax compliance.

Additional Resources for Guidance

For those who are unsure about any part of the Form W-9, there are several resources available to provide guidance:

IRS Website

The official IRS website offers detailed instructions and FAQs on how to fill out Form W-9. It is a reliable source for ensuring compliance with IRS regulations.

Tax Professionals

Consulting a tax professional can provide personalized advice and help in filling out the form correctly. They can also address any specific questions or concerns you may have.

Online Tools and Software

Tools like Instafill.ai, which assist in filling out government forms, can help streamline the process and reduce the risk of errors. However, always verify the accuracy of the information entered.

Using these resources can help ensure that your Form W-9 is completed correctly and efficiently, reducing the risk of errors and complications.

Stay Updated

For the most current and comprehensive instructions on filling out Form W-9, visit our detailed guide. This resource provides up-to-date information to help you complete your Form W-9 accurately and efficiently.

Common Mistakes to Avoid When Filling Out Form W-9

When completing Form W-9, it is crucial to be meticulous to avoid errors that could lead to delays or complications in the tax reporting process. Here are some common mistakes to watch out for:

Inconsistent Naming

Ensure that the name provided on the Form W-9 matches exactly the name on your tax return. Any discrepancies can lead to issues with the IRS matching your records, so it is essential to double-check this information.

Incorrect Taxpayer Identification Number (TIN)

Using the wrong TIN, whether it is a Social Security Number (SSN) or an Employer Identification Number (EIN), can cause significant problems. Make sure to use the correct TIN that corresponds to your tax status.

Missing or Incorrect Address

The address provided must be accurate and up-to-date. This includes the street address, city, state, and ZIP code. An incorrect address can result in missed communications and delays.

Unchecked or Incorrect Federal Tax Classification

Selecting the wrong federal tax classification can affect how your taxes are reported. Ensure you check the correct box that reflects your tax status, such as "Individual/Sole Proprietor or Single-Member LLC."

Omitting Signature and Date

The Form W-9 is not valid without a signature and date. Always sign and date the form, and ensure the signature matches your legal name.

Failing to Secure Sensitive Information

Given the sensitive nature of the information on Form W-9, it is vital to transfer the document securely. Use encrypted email or a secure online portal to protect your personal and business information.

Ignoring Requester’s Instructions

If the requester has provided specific instructions for filling out or submitting the Form W-9, make sure to follow them carefully. Ignoring these instructions can lead to the form being rejected or delayed.

Not Updating Information

If your name, address, or other details change, it is essential to submit a new Form W-9 to the requester. Failure to update this information can lead to inaccuracies in tax reporting.

By being aware of these common mistakes, you can ensure that your Form W-9 is completed accurately and efficiently, avoiding any potential issues with tax compliance.

Additional Resources for Guidance

For those who are unsure about any part of the Form W-9, there are several resources available to provide guidance:

IRS Website

The official IRS website offers detailed instructions and FAQs on how to fill out Form W-9. It is a reliable source for ensuring compliance with IRS regulations.

Tax Professionals

Consulting a tax professional can provide personalized advice and help in filling out the form correctly. They can also address any specific questions or concerns you may have.

Online Tools and Software

Tools like Instafill.ai, which assist in filling out government forms, can help streamline the process and reduce the risk of errors. However, always verify the accuracy of the information entered.

Using these resources can help ensure that your Form W-9 is completed correctly and efficiently, reducing the risk of errors and complications.

By following these steps and referring to the example provided, you can confidently complete your W-9 form and ensure that you have provided the requester with the accurate, necessary information.

Section 1: Personal Information

Name and Tax Return Details

- Name (as shown on your tax return):

- Enter your full name exactly as it appears on your tax return.

- Example: Olivia Martinez

- Explanation:

- This field is crucial for matching your tax records. Ensure the name is consistent with what you have reported to the IRS.

Address

- Address, City, State, and ZIP Code:

- Provide your current address, including the street, city, state, and ZIP code.

- Example: 456 Pine Street, Redwood City, CA 94063

- Explanation:

- This address will be used for correspondence and should be your current residential or business address.

Section 2: Business Information

Business Name/Disregarded Entity Name

- Business Name/Disregarded Entity Name (if different from above):

- If your business name is different from your personal name, enter it here.

- Example: Olivia Martinez Consulting

- Explanation:

- This is necessary for businesses, sole proprietors, or single-member LLCs to distinguish between personal and business identities.

Federal Tax Classification

- Federal Tax Classification:

- Check the appropriate box that describes your tax classification (e.g., Individual/Sole Proprietor or Single-Member LLC).

- Example: Individual/Sole Proprietor or Single-Member LLC

- Explanation:

- This classification helps the IRS and the requester understand your tax status.

Section 3: Exemptions

Exemptions (if any)

- Exemptions (if any):

- If you are exempt from certain federal taxes, indicate the exemption here. Otherwise, leave this section blank.

- Explanation:

- This section is for specific tax exemptions that may apply to your situation.

Section 4: Requester’s Information

Requester’s Name and Address (Optional)

- Requester’s Name and Address (Optional):

- If the payer has provided their name and address, enter it here. Otherwise, leave this section blank.

- Explanation:

- This information is optional and only required if specified by the requester.

Section 5: Taxpayer Identification Number (TIN)

Taxpayer Identification Number (TIN)

- Taxpayer Identification Number (TIN):

- Enter your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your tax status.

- Example: 412-55-1234 (SSN) or your EIN if applicable

- Explanation:

- This is the critical identifier that links you to your tax records.

Section 6: Certification

Certification

- Certification:

- Sign and date the form to certify that the information provided is correct and that you are not subject to backup withholding unless otherwise noted.

- Example: Signature - Olivia Martinez, Date - 06/15/2024

- Explanation:

- Your signature and date validate the form and ensure compliance with IRS regulations.