How to Fill Out Form 4506-T, Request for Transcript of Tax Return (Example Included)

Obtaining a transcript of a previously filed tax return can be essential for various financial transactions, such as applying for a mortgage, verifying income, or confirming tax details for loan applications. Form 4506-T, officially known as the Request for Transcript of Tax Return, is the IRS document used to request this information at no cost. Below are guidelines and considerations for completing this form accurately and efficiently.

For the official instructions and the most up-to-date information, visit the IRS website.

Purpose of Form 4506-T

Form 4506-T allows taxpayers to obtain a transcript—a summary—of previously filed tax returns. While Form 4506 requests a full copy (with a fee), Form 4506-T provides a free transcript. These transcripts are commonly used by individuals, mortgage lenders, and other financial institutions to confirm reported income and tax-related data.

Information Needed to Complete Form 4506-T

-

Taxpayer Identification Details:

- Name (and spouse’s name if applicable): Use the exact name as it appeared on the original return. For example:

- Primary Name: Elizabeth Carter

- Spouse’s Name: Paul Carter

- Taxpayer Identification Number (TIN): Typically a Social Security Number (SSN) for individuals. Example:

- SSN: 987-65-4329

- Current Mailing Address: Provide the address where the transcript should be sent. Example:

- 2517 Maple Grove Lane, Denver, CO 80202

- Previous Address (If Different): If the address on the requested return differs from your current address, also provide the old address. Example:

- 1024 Elm Street, Chicago, IL 60611

- Name (and spouse’s name if applicable): Use the exact name as it appeared on the original return. For example:

-

Type of Transcript and Tax Form:

- Type of Transcript Requested: For example, “Return Transcript” if you need a summary of previously filed returns.

- Tax Form Number: Commonly a Form 1040 series.

- Tax Years or Periods: Specify each year needed, such as 2023 and 2024.

-

Third-Party Recipient (If Applicable):

If sending the transcript directly to a third party, provide their name, address, and any required contact details. For instance:- Third Party: Anderson & Associates Mortgage Lending

- Address: 1547 Westwood Avenue, Los Angeles, CA 90025

Double-check this information to ensure proper delivery.

-

Signature and Date:

Only the taxpayer (and spouse, if filing jointly) can sign. By signing, you authorize the IRS to release the transcript. Both Elizabeth and Paul Carter must sign if it’s a joint request.

Types of Transcripts Available

Understanding the different types of transcripts provided by the IRS is crucial to ensure you request the most appropriate document for your specific needs. Here are the primary types of transcripts you can obtain using Form 4506-T:

Return Transcript

A Return Transcript provides most of the line items from your original tax return as filed, including any accompanying forms and schedules. It is commonly used for loan applications, verification of income, and reviewing previously filed data without the need for a full copy of the tax return.

Account Transcript

An Account Transcript includes basic data such as filing status, taxable income, and payment types, along with any adjustments made after the return was filed. This transcript is useful for resolving discrepancies, understanding account balances, and addressing issues related to payments or penalties.

Record of Account Transcript

The Record of Account Transcript combines both the Return Transcript and the Account Transcript, offering a comprehensive overview of your tax return and all account activity. This type is beneficial when a detailed history of your tax account is required, such as during audits or when discrepancies need thorough investigation.

Wage and Income Transcript

A Wage and Income Transcript provides data from information returns the IRS receives, such as Forms W-2, 1099, 1098, and others. This transcript is essential for verifying income sources, preparing tax returns, and ensuring that all income has been accurately reported to the IRS.

Verification of Non-filing Letter

The Verification of Non-filing Letter confirms that the IRS has no record of a filed Form 1040, 1040A, or 1040EZ for the year you requested. This document is often required when applying for financial aid, student loans, or other situations where proof of non-filing is necessary.

By familiarizing yourself with these transcript types, you can select the most appropriate form to request, streamlining the process and ensuring you receive the necessary information without delays.

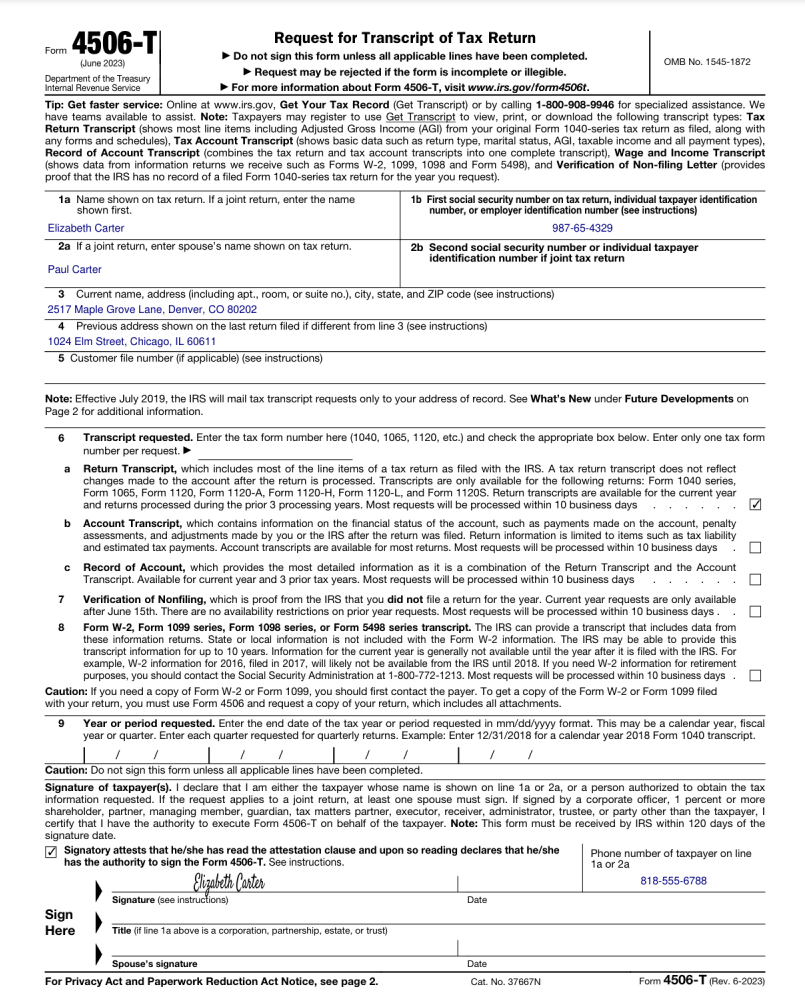

Example of a Completed Form

To understand proper formatting and data entry, review the sample completed Form 4506-T below. This example helps you avoid common mistakes and ensures that every field is addressed correctly.

Download Filled Form 4506-T PDF Example

Instafill.ai was used to complete this Form 4506-T, helping minimize errors and save time. For a convenient way to fill out the 4506-T form, visit 4506-t Instafill.ai.

Organizing and Sending the Request

After completing the form, verify each entry for accuracy. The IRS instructions detail where to mail or fax the form based on your location. Consider using a mail service that provides tracking, so you will know when the IRS receives it.

-

No Fee: Transcripts requested via Form 4506-T are generally provided free of charge. After completing the form, verify each entry for accuracy. The IRS instructions detail where to mail or fax the form based on your location. It’s important to note that the mailing address you provide can impact the processing time. If your current mailing address is different from the previous address used on your tax return, this may lead to delays in processing your request. Ensure that you provide the correct and complete address information to avoid any potential hold-ups. Consider using a mail service that provides tracking, so you will know when the IRS receives it.

-

Processing Time: Expect the IRS to take several days to weeks to process and mail the requested transcript.

For additional guidance, check out this video walkthrough on completing IRS Form 4506-T, Request for Transcript of Tax Return.

Retaining Copies and Back-Up

Keep a personal copy of the completed form and note the submission date. Having these records readily available can simplify follow-up if you need to contact the IRS regarding your request.

Additional Tips

- Match TIN and Names Exactly: Use the precise spelling and numbering from the originally filed return.

- Specify Needed Years Clearly: Providing exact years ensures you receive the correct transcripts.

- Review Before Signing: Confirm all information is correct to prevent delays.

By carefully following these steps, using the example as a guide, and referencing official IRS instructions, you can submit a well-prepared Form 4506-T and obtain tax transcripts promptly and accurately.