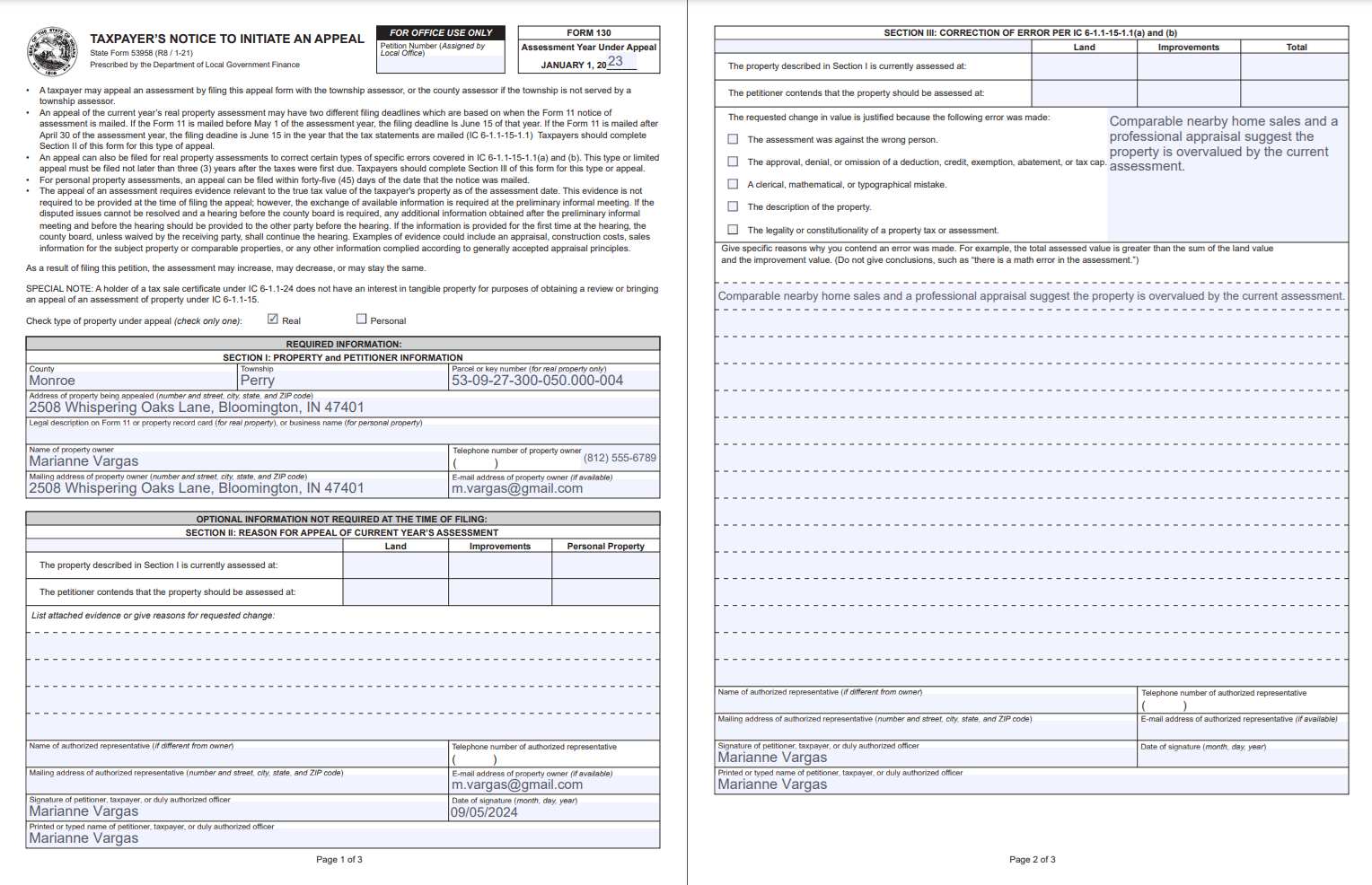

Taxpayer Notice to Initiate an Appeal Example. How I Filled Out Indiana Form 130

Addressing an unexpected property tax assessment often involves initiating a formal appeal. In Indiana, Form 130 Taxpayer Notice to Initiate an Appeal—serves as the official request to have a property’s assessed value reconsidered. Outlined below are steps and considerations for completing this form, based on practical experience and widely accepted guidelines.

Understanding the Purpose of Form 130

Form 130 notifies local assessment officials that the property owner disagrees with the current valuation. It’s typically used when evidence suggests that the assessment does not reflect the property’s true market value or contains factual errors.

For more detailed guidance, the Indiana Department of Local Government Finance (DLGF) website offers official instructions, and local county assessor’s offices can clarify specific requirements.

Before starting, it’s wise to gather relevant documents—recent sales data, appraisals, or property condition reports—to support the case.

Filling Out the Key Sections

Owner’s Name and Mailing Address:

Use the exact name as recorded in official property documents. For this example:

- Name: Marianne Vargas

- Mailing Address: 2508 Whispering Oaks Lane, Bloomington, IN 47401

County and Township:

Identify the county and township where the property is located. These details can be found on assessment notices or county property records.

- County: Monroe

- Township: Perry

Property Identification:

Locating the correct parcel number is critical. This unique identifier, often found on assessment notices or county property records, ensures accuracy.

- Parcel Number: 53-09-27-300-050.000-004

Property Address (If Different from Mailing Address):

Provide the physical location of the property under appeal, if it’s not the same as the owner’s mailing address.

- Property Address: 2508 Whispering Oaks Lane, Bloomington, IN 47401

Assessment Year and Date Under Appeal:

Double-check the year stated on the assessment notice before entering it here. Include the assessment date if required (often January 1 of the given year).

- Assessment Year: 2023

- Assessment Date: January 1, 2023

Classification and Type of Property:

Indicate whether the property is residential, commercial, agricultural, or otherwise, as classifications can affect assessments.

- Property Type: Residential Single-Family

Reason for the Appeal:

Keep the explanation factual and concise. Perhaps a recent professional appraisal or neighboring properties’ sale prices indicate that the current assessed value is inflated. Outline these points clearly without excessive detail.

- Stated Reason: Comparable nearby home sales and a professional appraisal suggest the property is overvalued by the current assessment.

Proposed Corrected Assessment (If Applicable):

If the form allows, provide an estimate of what the owner believes to be a fair assessed value based on evidence.

- Proposed Assessment: $180,000 (compared to the current $200,000 assessment)

Informal Meeting or Request for Review (If Required):

Some counties ask if the owner has attempted to resolve the matter informally with the assessor before filing Form 130.

- Informal Meeting Held? No

- Informal Meeting Requested? Yes

Contact Information and Representation:

Provide a direct phone number and email so the assessor’s office can request clarification if needed. If no representative (such as an attorney or tax consultant) is involved, leave that section blank.

- Phone: (812) 555-6789

- Email: [email protected]

- Representative: None

Collecting and Organizing Supporting Documents

Comparable sales data, photographs illustrating property conditions, and a recent appraisal can form a convincing case. Attaching these documents in an organized manner—labeled and referenced in your notes—helps decision-makers review the appeal efficiently. Include:

- Comparable Sales Listings: At least three recently sold properties of similar size, age, and location.

- Certified Appraisal Report: Dated within the last 12 months.

- Photographs of the Property: Highlighting any unique features or conditions impacting value.

Signing and Dating the Form

Just like other official tax documents, Form 130 requires a signature and date to validate the submission. Ensure that all entries are accurate before signing.

Signature: Marianne Vargas

Date: 09/05/2024

Timelines and Deadlines for Filing an Appeal Using Form 130 in Indiana

When initiating an appeal using Form 130 in Indiana, it is crucial to be aware of the specific timelines and deadlines to ensure that your appeal is processed without any issues.

Filing Deadlines

The deadline for filing Form 130 varies depending on the assessment year and the type of appeal. Here are the general guidelines:

- Annual Assessment Appeals: For annual assessments, the appeal must be filed within 45 days of the date the assessment notice was mailed to the property owner. This notice is typically sent in the spring or early summer.

- Correcting Errors: If the appeal is based on an error in the assessment, such as an incorrect parcel number or a miscalculation, the filing deadline may be extended. However, it is essential to contact the local assessor’s office to confirm the specific deadline for such cases.

- Special Assessments: For special assessments, such as those resulting from new construction or improvements, the deadline for filing an appeal may differ. It is important to check the notice or contact the local assessor’s office for the exact deadline.

Consequences of Late Submissions

Failing to meet the filing deadlines can result in the appeal being rejected. Here are some key consequences to consider:

- Rejection of Appeal: If Form 130 is not filed within the specified deadline, the appeal may be rejected, and the property owner will have to wait until the next assessment year to file a new appeal.

- Loss of Rights: Missing the deadline can result in the loss of the right to appeal the current year’s assessment. This means the property owner will have to accept the current assessed value or seek other legal remedies, which may be more complex and costly.

- Impact on Future Assessments: Late submissions can also impact future assessments. If an appeal is not filed on time, any errors or discrepancies in the current year’s assessment may carry over to subsequent years, potentially leading to ongoing overvaluation.

Best Practices for Meeting Deadlines

To avoid the consequences of late submissions, follow these best practices:

- Track Key Dates: Keep a record of the assessment notice date and calculate the 45-day deadline accordingly.

- Prepare Early: Gather all necessary documents and information well in advance to ensure that Form 130 can be completed accurately and submitted on time.

- Verify Local Requirements: Always check with the local assessor’s office for any specific requirements or variations in deadlines that may apply in your area.

- Use Tracking Services: When submitting the form by mail, use a service that provides delivery confirmation or tracking to ensure the form is received by the deadline.

By understanding and adhering to these timelines and deadlines, property owners can ensure their appeals are processed efficiently and effectively, avoiding potential rejections and maintaining their rights to a fair assessment.

Submission Methods

Each county may have slightly different submission procedures. Some offices accept forms by mail, others allow drop-offs, and a few offer electronic submission portals. When mailing, consider using a service that provides delivery confirmation or tracking. Prompt submission before the stated deadline is essential to ensure the appeal is heard.

Keep a Personal Copy: Always retain a copy of the completed Form 130 and all supporting documents for your own records. This can be useful if the appeal board requests additional information or if any follow-up actions become necessary.

Example of a Completed Form

For reference, a sample completed Form 130 is provided below. Reviewing this example can help you anticipate the correct formatting and level of detail.

Download filled Form 130 PDF example

For a detailed guide on how to fill out Form 130, watch this helpful video: How to fill out Indiana Form 130 (53958) | Taxpayer's Notice to Initiate an Appeal

Leveraging Instafill.ai for a Seamless Form 130 Filing Experience

To enhance the efficiency and accuracy of filing Form 130, utilizing advanced tools like Instafill.ai can be a game-changer. Here’s how you can transform your filing experience with this innovative tool.

Why Choose Instafill.ai?

Instafill.ai is designed to streamline the process of filling out Form 130, ensuring that every section is accurately addressed and minimizing the risk of errors. Here are some key benefits of using Instafill.ai:

Accuracy and Precision

Instafill.ai guides you through each field, reducing the likelihood of typos, incorrect details, and incomplete information. This ensures that your form is filled out correctly the first time, saving you time and hassle.

Time Efficiency

The AI-powered form filler automates the process, allowing you to complete Form 130 much faster than manual filling. This is particularly useful when you have multiple forms to fill or when you are working under tight deadlines.

User-Friendly Interface

The interface of Instafill.ai is intuitive and easy to navigate, making it accessible even for those who are not tech-savvy. The step-by-step guidance ensures that you do not miss any critical sections or requirements.

Compliance with Local Regulations

Instafill.ai can be updated to reflect any specific local instructions or variations in filing requirements. This ensures that your form complies with all the necessary regulations, reducing the risk of rejection due to non-compliance.

How to Get Started with Instafill.ai

Getting started with Instafill.ai is straightforward:

- Visit the Instafill.ai Website: Go to the Instafill.ai website and select the option for filling out Form 130.

- Follow the Prompts: The AI will guide you through each section of the form, prompting you to enter the necessary information.

- Review and Submit: Once you have filled out all the sections, review the form for accuracy and submit it.

Transform Your Filing Experience

By using Instafill.ai, you can significantly enhance your Form 130 filing experience. Here’s a compelling call to action to motivate you to start now:

Transform your filing experience with Instafill.ai—start your hassle-free Form 130 submission now

With Instafill.ai, you can ensure accuracy, save time, and avoid common mistakes that could jeopardize your appeal. Don’t wait; streamline your process today and make filing Form 130 a breeze.

Additional Tips for Using Instafill.ai Effectively

- Keep Your Documents Ready: Have all the necessary documents, such as parcel numbers, assessment years, and supporting evidence, ready before you start filling out the form.

- Double-Check Entries: Even though Instafill.ai minimizes errors, it’s always a good idea to double-check your entries against official documents.

- Save a Copy: After submitting your form, save a copy for your records. This can be useful if the appeal board requests additional information.

By integrating Instafill.ai into your Form 130 filing process, you can ensure a smooth, accurate, and efficient submission, enhancing your overall experience and the success of your appeal.

Leveraging Instafill.ai for a Seamless Form 130 Filing Experience

To enhance the efficiency and accuracy of filing Form 130, utilizing advanced tools like Instafill.ai can be a game-changer. Here’s how you can transform your filing experience with this innovative tool.

Why Choose Instafill.ai?

Instafill.ai is designed to streamline the process of filling out Form 130, ensuring that every section is accurately addressed and minimizing the risk of errors. Here are some key benefits of using Instafill.ai:

Accuracy and Precision

Instafill.ai guides you through each field, reducing the likelihood of typos, incorrect details, and incomplete information. This ensures that your form is filled out correctly the first time, saving you time and hassle.

Time Efficiency

The AI-powered form filler automates the process, allowing you to complete Form 130 much faster than manual filling. This is particularly useful when you have multiple forms to fill or when you are working under tight deadlines.

User-Friendly Interface

The interface of Instafill.ai is intuitive and easy to navigate, making it accessible even for those who are not tech-savvy. The step-by-step guidance ensures that you do not miss any critical sections or requirements.

Compliance with Local Regulations

Instafill.ai can be updated to reflect any specific local instructions or variations in filing requirements. This ensures that your form complies with all the necessary regulations, reducing the risk of rejection due to non-compliance.

How to Get Started with Instafill.ai

Getting started with Instafill.ai is straightforward:

- Visit the Instafill.ai Website: Go to the Instafill.ai website and select the option for filling out Form 130.

- Follow the Prompts: The AI will guide you through each section of the form, prompting you to enter the necessary information.

- Review and Submit: Once you have filled out all the sections, review the form for accuracy and submit it.

Transform Your Filing Experience

By using Instafill.ai, you can significantly enhance your Form 130 filing experience. Here’s a compelling call to action to motivate you to start now:

Transform your filing experience with Instafill.ai—start your hassle-free Form 130 submission now

With Instafill.ai, you can ensure accuracy, save time, and avoid common mistakes that could jeopardize your appeal. Don’t wait; streamline your process today and make filing Form 130 a breeze.

Additional Tips for Using Instafill.ai Effectively

- Keep Your Documents Ready: Have all the necessary documents, such as parcel numbers, assessment years, and supporting evidence, ready before you start filling out the form.

- Double-Check Entries: Even though Instafill.ai minimizes errors, it’s always a good idea to double-check your entries against official documents.

- Save a Copy: After submitting your form, save a copy for your records. This can be useful if the appeal board requests additional information.

By integrating Instafill.ai into your Form 130 filing process, you can ensure a smooth, accurate, and efficient submission, enhancing your overall experience and the success of your appeal.

Fill the Form with Instafill.ai Help

To streamline the process, I used Instafill.ai. This online AI Form Filler guided the completion of each field and minimized the risk of errors. Using this app saves time and ensures that every section is accurately addressed. For an easy and convenient way to fill out your Form 130, visit Form 130 Instafill.ai.

Common Mistakes to Avoid When Filing Form 130 While completing Form 130 is straightforward, common errors can arise that may jeopardize an appeal. Here are some pitfalls to avoid to ensure your appeal proceeds smoothly:

-

Incomplete Information: Leaving sections blank can lead to delays or rejections. Ensure that all required fields, such as parcel number and assessment year, are filled out completely.

-

Incorrect Details: Simple typos, like misspelled names or incorrect addresses, can cause significant issues. Double-check all entries against official documents to ensure accuracy.

-

Insufficient Documentation: Failing to attach necessary supporting documents, such as comparable sales or appraisals, can weaken your case. Always include solid evidence that supports your appeal.

-

Missing Signature or Date: Just like any legal form, Form 130 must be signed and dated. An unsigned form is not valid and will be returned.

-

Late Submission: Pay careful attention to submission deadlines. Submitting forms past the deadline can result in automatic denial of the appeal.

-

Neglecting Local Instructions: Each county may have its own rules or variations for filing. Be sure to check the guidelines provided by your local county assessor’s office to ensure compliance.

By being aware of these common mistakes, taxpayers can enhance their chances of submitting a successful appeal and ensure that their concerns regarding property assessments are addressed effectively.

Additional Tips

- Highlight Objective Evidence: Prioritize data-driven materials such as official sales records or certified appraisals.

- Stay Informed: Check local regulations, as Indiana property tax appeal processes can vary slightly by county.

- Seek Professional Advice if Uncertain: Property tax consultants, real estate attorneys, or knowledgeable local agents can offer valuable guidance if confusion arises.

By methodically preparing Form 130, gathering solid evidence, and following local instructions, it becomes possible to present a well-structured appeal. The ultimate goal is to ensure that the property’s assessed value aligns more closely with its actual worth.